- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

DARPA Just Picked IonQ in a Major Win for the Quantum Computing Company. Is That Enough to Buy IONQ Stock on the Dip?

/Quantum%20Computing/A%20concept%20image%20showing%20a%20ray%20of%20light%20passing%20through%20cyberspace_%20Image%20by%20metamorworks%20via%20Shutterstock_.jpg)

Pure-play quantum computing company IonQ (IONQ) just locked in a major win on April 3, landing a spot in the first stage of the Defense Advanced Research Projects Agency’s (DARPA) Quantum Benchmarking Initiative (QBI). The goal of this program is to explore whether useful, real-world quantum computers can be built sooner than expected. With its strong history of innovation and real-world applications, IonQ is helping set the bar for what the future of quantum should look like.

As part of this first stage, IonQ will help define what it really means for a quantum computer to be “utility-scale” by working with DARPA on real-world use cases that require massive computing power. At the same time, the company is pushing ahead with its own cutting-edge quantum tech. Its Forte and Forte Enterprise systems are already being used in industries like logistics, finance, pharma, and artificial intelligence (AI), giving IonQ a strong edge when it comes to contributing meaningful insights to this program.

And even though shares of the company have crashed despite this major win as global markets tumbled on the back of President Donald Trump's reciprocal tariff hammer, with quantum adoption gaining serious momentum, can this DARPA nod be the perfect reason to scoop up IonQ’s shares on the dip now?

About IonQ Stock

Valued at $5.1 billion by market cap, Maryland-based IonQ (IONQ) is leading the quantum computing revolution with a bold mission to solve the world’s most complex challenges. IonQ’s quantum computers leverage qubits, units that can represent both 0 and 1 simultaneously, unlocking speeds far beyond those of traditional binary systems.

What sets IonQ apart is its ability to shrink quantum machines from room-sized giants to compact, inch-scale systems. Its trapped-ion technology makes these systems more precise, affordable, and scalable than ever before. Despite the current market volatility weighing on IonQ’s stock, the company’s long-term growth story is hard to ignore.

Even after factoring in a sharp 61% pullback from its January peak of $54.74, the stock is still up a remarkable 154% over the past year. For context, the broader S&P 500 Index ($SPX) has slumped roughly 4.2% during the same stretch. Plus, over the past six months, shares of this quantum computing player have returned an impressive 122%.

While IonQ’s valuation has certainly cooled from its earlier highs, calling it a bargain would be a stretch. Presently trading at a lofty 106.99 times sales, the stock is still priced significantly above its sector median of just 2.42x, reflecting sky-high investor expectations.

Digging Into IonQ’s Q4 Financial Performance

The trapped-ion technology company dropped its 2024 fourth-quarter earnings release on Feb. 26, which painted a somewhat mixed picture. Revenue came in at $11.7 million, soaring 91.8% year-over-year and not only crushing Wall Street expectations but also surpassing the company’s own high-end guidance of $11.1 million. Full-year bookings were just as impressive, coming in at $95.6 million and surpassing the upper limit of its previously projected range of $75 million to $95 million, indicating solid long-term demand for its quantum tech.

Riding high on these results, management proudly declared 2024 as IonQ’s “best year yet.” But, despite delivering blowout revenue and booking numbers, IonQ’s stock took a sharp 16.8% dive in the very next trading session. The selloff was largely fueled by a net loss of $0.93 per share in the fourth quarter, far worse than the $0.20 loss per share reported a year earlier and well below Wall Street’s estimated figure of a $0.25 loss per share.

Adding to the pressure, the company announced plans to raise up to $500 million through an “at-the-market” stock offering, with Morgan Stanley and Needham at the helm. The move signaled ongoing cash burn and raised concerns over shareholder dilution. While IonQ boasts a healthy $363.8 million in cash, cash equivalents, and investments as of Dec. 31, 2024, its $124 million annual burn rate means that money won’t stretch forever.

So, the $500 million raise gives IonQ roughly four years of runway to sustain operations and fuel its quantum ambitions. Moreover, IonQ’s fiscal 2025 outlook points to a big growth push, with revenue projected to be between $75 million and $95 million. Plus, management expects the first quarter's revenue to land between $7 million and $8 million. On the other hand, analysts monitoring IonQ forecast the company’s loss to narrow 49.4% year over year in fiscal 2025 and shrink another 1.3% in fiscal 2026.

What Do Analysts Expect for IonQ Stock?

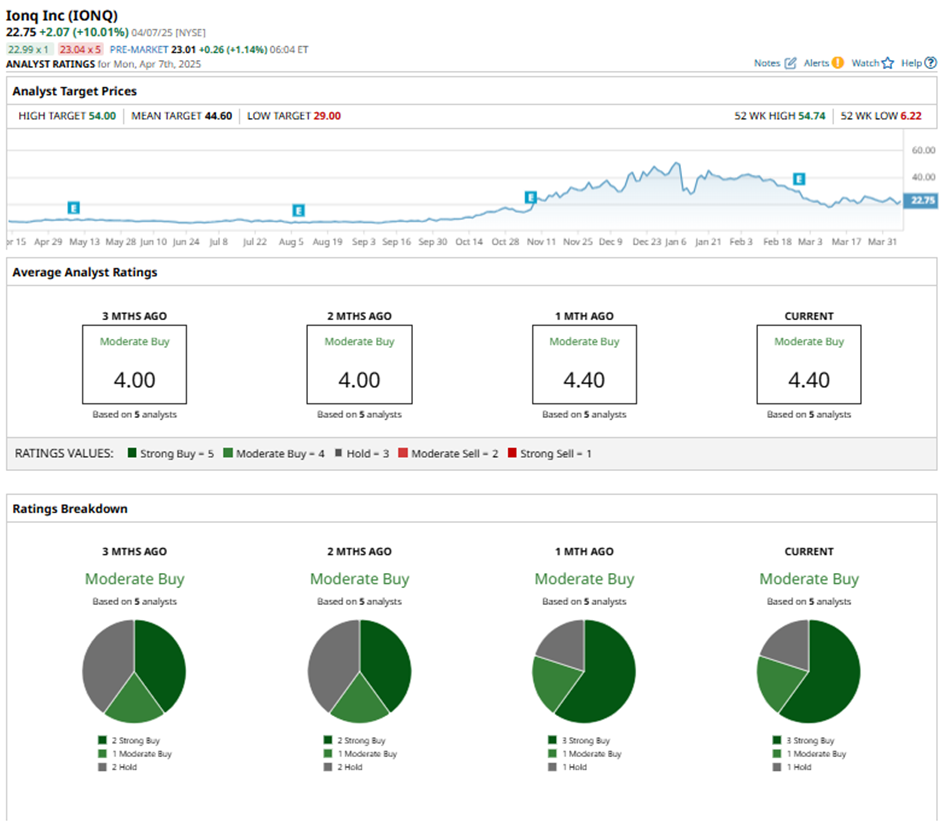

Despite widening losses revealed in its latest earnings release, Wall Street isn’t backing down on IONQ stock just yet, sticking to a “Moderate Buy” rating overall. Of the five analysts offering recommendations, three advocate a “Strong Buy,” one gives a “Moderate Buy,” and the remaining one suggests a “Hold.” The average price target of $44.60 represents potential upside of more than 100%.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.